Use LTC and CAC to Scale your SaaS (here’s how)

In order to scale your SaaS, you really need to look at 2 metrics: LTV and CAC.

Obviously, you have more metrics available, like visitors, views, or even daily sign-ups, but those are really what they call “vanity metrics.” they’re cool and all, and sure, each of those has its own purpose, but they won’t really tell you what moves to make next.

LTV & CAC is what you need!

What is LTV?

LTV stands for = Life Time Value.

So the time a customer stays on as a customer.

What is CAC?

CAC stands for: Custer Acquisition Cost.

So, how much does it cost to get a paying customer on board?

How to measure CAC & LTV?

Now, before you go all crazy about these numbers and the data, you can very easily calculate these numbers by using a tool like Baremetrics for example by connecting your payment provider like Stripe for example. It’ll basically auto-generate these numbers and stats for you.

LTV and CAC: how does it work?

But, in this post, I’m going to explain to you real quick why LTV and CAC are important and what you can do to positively influence these numbers.

LTV: Life Time Value

So the Life time Value is the amount of money that users are bringing us before the leave our product.

Now, to find out how much we make per user, we'll divide the ‘Average Revenue Per Account’ by the ‘Customer Churn Rate.’

So this is a game of measuring the average metrics

So let’s say you have 3 plans like I do with Feedefy:

Some of the users will be on the lowest tier, some in the middle, and some in the biggest tier.

But of all paying customers, there’s an average I make per customer

So let’s say the average revenue of my customer is 19 dollars.

And let’s say, on average, each customer stays on for 10 months.

So again, this is average, some will churn after 3 months, some will stay on for 3 years.

But on average, you see that customers are staying on for 10 months.

Then we have an average of $19 of revenue for 10 months.

This results in an LTV of $19 dollars times 10 months = $190 in LTV.

So each new customer is likely to bring in $190 dollars of revenue.

CAC: Customer Acquisition Cost

Now that you know that, we can start looking at the next metric, which is CAC, the Customer Acquisition Cost.

Because now we can actually calculate how much we can spend to acquire 1 new customer.

So everything that costs less than 190 dollars to acquire 1 customer will result in profit.

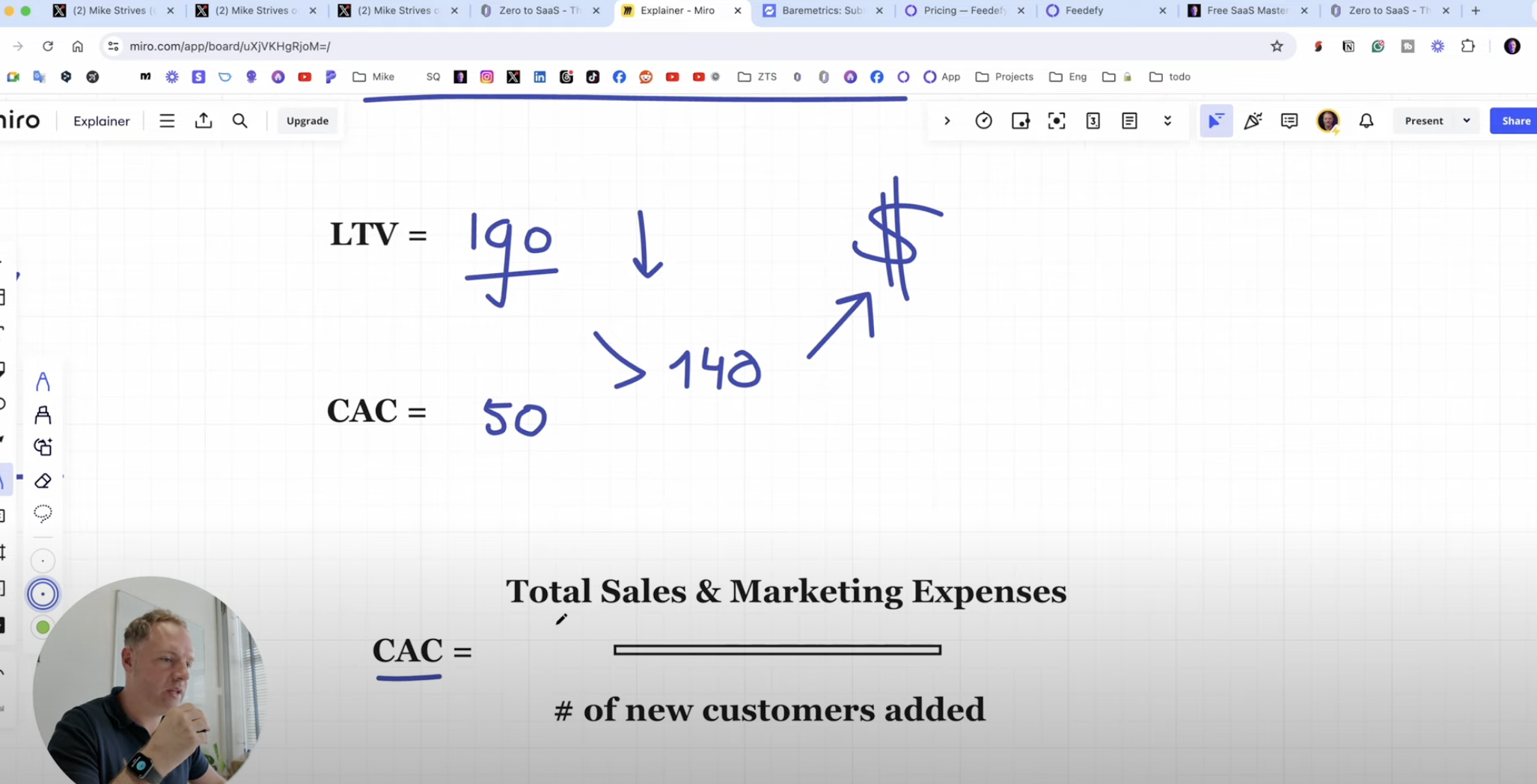

For example, if we spend on average of 50 dollars to acquire 1 new customer, we’ll have $190 of LTV minus - the 50 dollars spend to acquire = results in $140 dollars profit per customer.

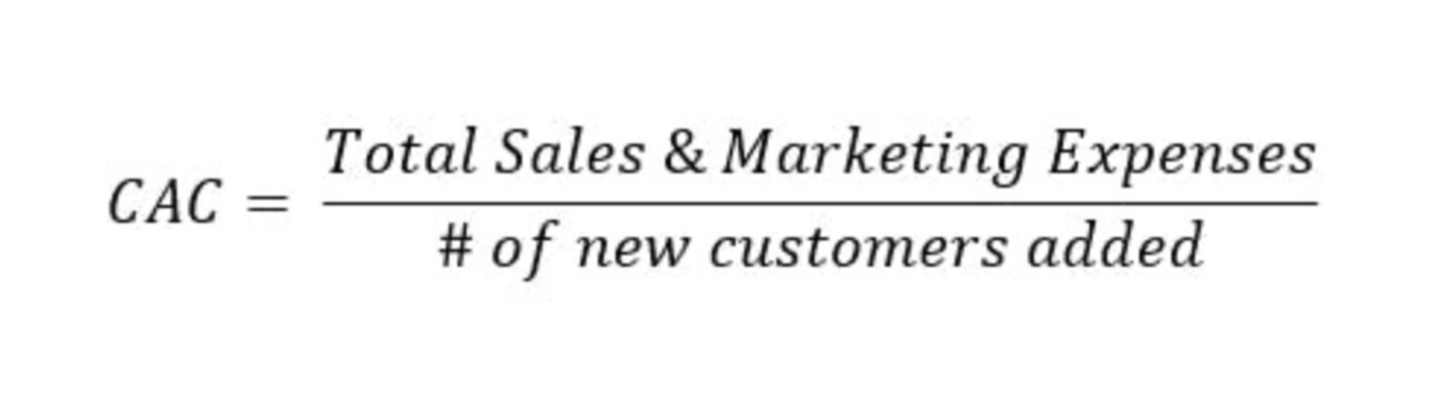

But, how do you find out what you actually spend on average to acquire 1 customer?

How do you find your CAC value?

Well, to discover your CAC you need to divide your total sales and marketing costs (let’s say for example $2000) by the number of new customers we added (let’s say 200).

And then you can simply calculate your CAC by dividing the $2000 in costs by the 200 acquired customers = which will leave us with a CAC of $10.

Now, in the example of today, where we have an LTV of $190, this is extremely good.

But the point is.

Without the LTV you can’t know if your CAC is healthy, and vice versa.

That’s why you need both metrics.

Now the fun part.

How to optimize LTV & CAC?

Because what if CAC and LTV don’t have a positive and healthy relation.

Something’s off.

For example, you’re paying too much to acquire a new customer or customer don’t stay long enough on the platform to justify its costs.

Now raising the LTV is the easiest of the two because with CAC you’re also depended on the marketing channels like for example the Meta Advertising platform, so if we go back to LTV, the customer life time value, we need to look at how we can extend the LTV average of our customers.

There are 3 sort-of-say “hacks” you can apply relatively easily:

You can work with annual plans → if more people sign up for annual plans, for example, by giving them a little discount, they will at least spend an x amount of money for a full year and will stay on for at least 12 months, giving you the opportunity to make them experience the value your product is offering and hopefully get them to extend their subscription which will result in a longer LTV

Raise your pricing: This is most of the time a scary thing to do, but believe me, raising your pricing is one of the best things you can do and is less scary then you initially think, if, and this is important, your product is valuable and the cost/benefit ratio is on point.

Winning strategies: I tech multiple winning strategies in my 5-star rated SaaS course.

So, for example, if people are saving thousands of dollars using your product and they’re now paying 50 dollars a month, it’s fair to say that you can slowly raise your pricing to 100 dollars per month or even a few over time.

Double down on what’s working!

Now so when you know the 2 metrics, CAC and LTV, and you start playing with all the variables like raising your pricing and working with annual plans, and you get this to work, so the CAC and LTV ratio becomes healthier and more efficient, you can basically double down on what’s working, for example putting in more dollars into your ad campaigns, and bascially scale the business to 7 figures and beyond.

Want to learn more?

If you want to learn everything there’s to know about SaaS, do check out the free SaaS mini-course, or, if you want to go all-in, come and join my private SaaS community by purchasing my 5-star rated SaaS course.

Catch you in the next one!

Mike